GROWTH STAGE

Armedangels - Nachhaltiges Fashion E-Commerce

AuctionTech - Online-Livestream Technologie für Auktionen

Chrono24 - Der Online-Weltmarktführer für Luxusuhren

Delivery Hero - Online-Essenslieferservice

Exozet – Agentur für 'Digitale Transformation'

Fiagon - MedTech für die HNO-Navigation

Friendsurance - Versicherungs-FinTech

Fyber - Mobile-Advertising-Monetarisierungsstrategien

Lingoda - Online-Sprachschule

Mister Spex - E-Commerce für Markenbrillen

Onefootball - Größte Online-Fußballplattform weltweit

reBuy - Der einfache An- und Verkaufsshop

Remerge - App Retargeting

Scalable Capital - Vermögensverwaltungstechnologie

Simplesurance - 1-Click-Online-Versicherung von Einkäufen

SoundCloud - Soziale Sound- und Musikplattform

Wunder Mobility - Mobilitätstechnologiedienstleister

EARLY STAGE

Amorelie - Erotisches E-Commerce

CRX Markets - Supply-Chain-Finance-Handelsplattform

Softwarelösungen für Bewertungsmanagement

eWings.com - Plattform für Flugbuchungen

Pyreg - GreenTec-Karbonisierungsanlagen

realbest - Online‐Transaktionsplattform für Immobilien

Thinksurance - Gewerbeversicherungsplattform

*An operativ tätigen Unternehmen (also ohne Zweckgesellschaften). Wir veröffentlichen Investments und damit die in unserem Portfolio enthalten Beteiligungen nach freiem Ermessen zu einem Zeitpunkt, der uns hinsichtlich des Portfoliounternehmens und uns selbst als geeignet erscheint. Die vorstehende Auflistung hat deshalb keinen Anspruch auf Vollständigkeit.

Down Was wir suchen

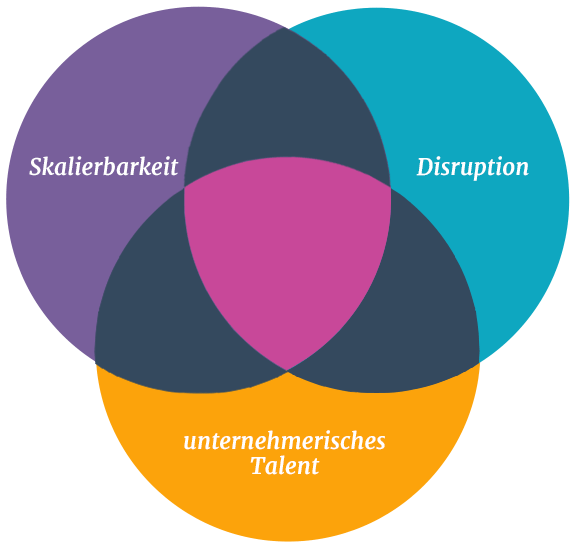

THINK BIG

Wir sind auf der Suche nach talentierten Entrepreneuren, die mit Wissen, Mut und Leidenschaft aus einem disruptiven Produkt oder Geschäftsmodell mit hoher Skalierbarkeit ein Unternehmen erschaffen. Bereits nachweisbare Traktion oder Umsätze sind ein Plus. Darüber hinaus erwerben wir auch “Secondary Shares” reiferer Startups von deren Gründern, Business Angels und frühen Investoren.